LOCAL BOUNTI CORPORATION

400 W. Main St., Hamilton, MT 59840

Notice of Special Meeting of Stockholders

To Be Held on April 26, 2023

You are cordially invited to attend a special meeting of stockholders (the “Special Meeting”) of Local Bounti Corporation (“Local Bounti,” “we,” “us,” or “our”) to be held on April 26, 2023, at 9 a.m. mountain time for the following purposes:

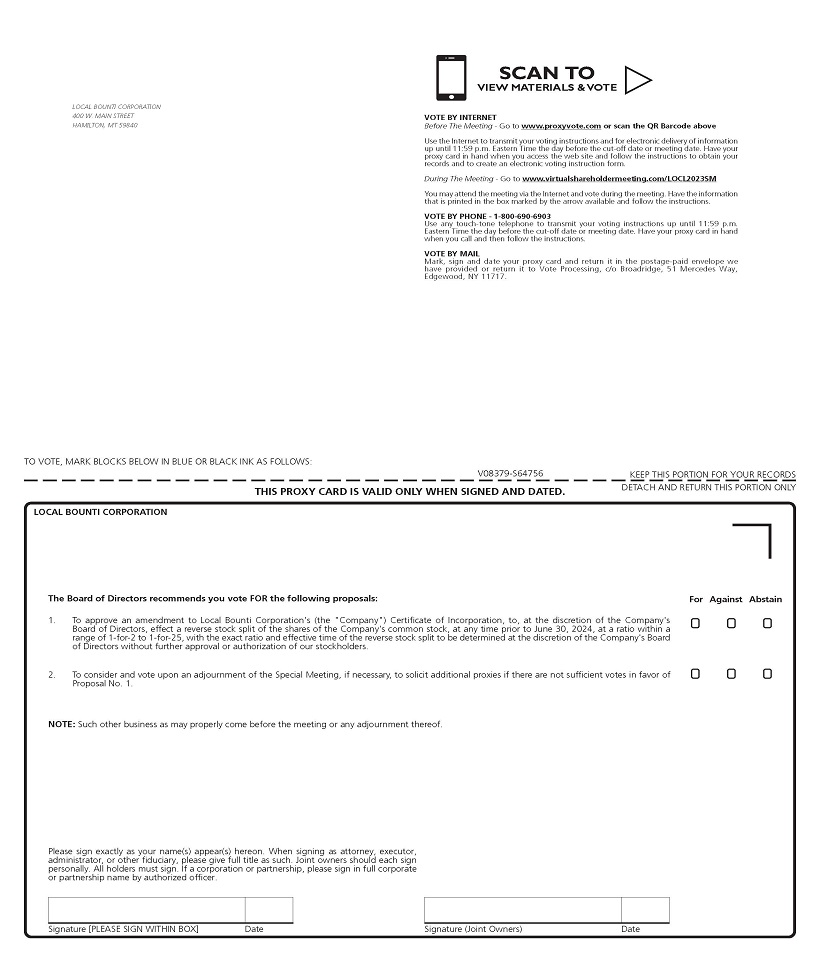

| 1. | To approve an amendment to our certificate of incorporation, in the form attached to the proxy statement as Annex A, to effect a reverse stock split of the shares of our common stock at a ratio within a range of 1-for-2 to 1-for-25, with the exact ratio and effective time of the reverse stock split to be determined by our Board of Directors in its sole discretion no later than June 30, 2024. |

| 2. | To consider and vote upon an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1. |

You can find more information about each of these items in the proxy statement accompanying this notice. The record date for the Special Meeting is April 3, 2023. Only stockholders of record at the close of business on that date may vote at the meeting or any postponement or adjournment of the meeting. These materials are first being delivered to stockholders on or about April 13, 2023.

The Board of Directors recommends that you vote in favor of Proposals 1 and 2, each as described in the accompanying proxy statement.

Under the rules of the Securities and Exchange Commission, we have elected to provide access to our proxy materials by notifying you of the availability of our proxy materials on the internet. This proxy statement is available on our website at localbounti.com and proxyvote.com.

The Special Meeting will be conducted exclusively via live audiocast at virtualshareholdermeeting.com/LOCL2023SM. There will not be a physical location for our Special Meeting, and you will not be able to attend the meeting in person.

You are cordially invited to attend the Special Meeting via live audiocast. Whether or not you expect to virtually attend the Special Meeting, please vote on the matters to be considered as promptly as possible to ensure your representation at the Special Meeting. You may vote via the internet, by telephone, or by returning the enclosed proxy card. Even if you have voted by proxy, you may still vote via live audiocast if you virtually attend the Special Meeting by going to virtualshareholdermeeting.com/LOCL2023SM and logging in using the 16-digit control number found on your proxy card or voting instruction form. Once you are admitted as a stockholder to the Special Meeting, you may vote and ask questions by following the instructions available on the meeting website. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

You are encouraged to log in to this website before the Special Meeting begins. Online check in will be available approximately 15 minutes before the meeting starts. If you encounter any difficulties accessing or participating in the meeting through the meeting website, please call the support team at the number listed on the website log-in screen.

By order of the Board of Directors

Margaret McCandless

Corporate Secretary

Hamilton, Montana

April 13, 2023