Exhibit 99.3 Pete’s® Strategic Acquisition Summary March 15, 2022 ©2022 Local Bounti Corp

Disclaimer FORWARDLOOKINGSTATEMENTS This presentation is for the purpose of summarizing certain aspects of the proposed acquisition (the “Transaction”) of the Hollandia Produce Group, Inc. (including related entities and subsidiaries), which does business as Pete’s (“Pete’s”) by Local Bounti Corporation (the “Company” or “Local Bounti”) pursuant to certain purchase agreements entered into among the parties (the “Purchase Agreements”). Certain statements in this presentation are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are often identified by words such as “anticipate,” “approximate,” “believe,” “commit,” “continue,” “could,” “estimate,” “expect,” “hope,” “intend,” “may,” “outlook,” “plan,” “project,” “potential,” “should,” “would,” “will” and other similar words or expressions. Such forward-looking statements reflect current expectations or beliefs concerning future events and actual events may differ materially from historical results or current expectations. The reader is cautioned not to place undue reliance on these forward-looking statements, which are not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside the control of the Company. The forward-looking statements in this presentation address a variety of subjects including, for example, the Transaction, the Company’s potential issuance of shares in satisfaction of the terms and conditions of the Purchase Agreements and the business prospects of the Company following the Transaction. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: the effects of disruption to Local Bounti’s businesses as a result of the Transaction; the impact of transaction costs on Local Bounti’s quarterly 2022 and full year 2022 financial results; Local Bounti’s ability to retain Pete’s customers following the consummation of the Transaction; Local Bounti’s ability to achieve the anticipated benefits from the Transaction; the uncertainty of water supply (and related uncertainty for certain water rights) for Pete’s facilities located in California; Local Bounti’s ability to effectively integrate the acquired operations into its own operations; the ability of Local Bounti to retain and hire key personnel; the uncertainty of projected financial information; the diversion of management time on Transaction-related issues; Local Bounti’s increased leverage as a result of additional indebtedness incurred in connection with the Transaction; restrictions contained in the Company’s debt facility agreements with Cargill; Local Bounti’s ability to repay, refinance, restructure and/or extend its indebtedness as it comes due; and unknown liabilities that may be assumed in the Transaction. In addition, actual results are subject to other risks and uncertainties that relate more broadly to the Company’s overall business, including Local Bounti’s ability to generate revenue; the risk that Local Bounti may never achieve or sustain profitability; the risk that Local Bounti could fail to effectively manage its future growth; the risk that Local Bounti will fail to obtain additional necessary capital when needed on acceptable terms, or at all; Local Bounti’s ability to build out additional facilities; reliance on third parties for construction, delays relating to material delivery and supply chains, and fluctuating material prices; Local Bounti’s ability to decrease its cost of goods sold over time; potential for damage to or problems with Local Bounti’s CEA facilities; Local Bounti’s ability to attract and retain qualified employees; Local Bounti ability to develop and maintain its brand or brands it may acquire; Local Bounti’s ability to maintain its company culture or focus on its vision as it grows; Local Bounti’s ability to execute on its growth strategy; the risks of diseases and pests destroying crops; Local Bounti’s ability to compete successfully in the highly competitive natural food market; Local Bounti’s ability to defend itself against intellectual property infringement claims; changes in consumer preferences, perception and spending habits in the food industry; seasonality; Local Bounti’s ability to achieve its sustainability goals; and other risks and uncertainties indicated from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Current Report on Form 8-K filed with the SEC on November 24, 2021, and subsequent annual reports on Form 10-K and quarterly reports on Form 10-Q, which reports are available on the SEC’s website at www.sec.gov. The forward-looking statements in this presentation speak only as of its date. Local Bounti undertakes no obligation to revise or update publicly any forward-looking statement, except as required by law. 2

Strategic Rationale Key Investment Considerations Pete’s represents an opportunity to invest in one of the country’s leading CEA platforms Synergistic Footprint Expansive CEA Retail Distribution Category Penetration/Differentiation Local Bounti Stack & Flow Technology™ Retrofit Opportunity 3

Pete’s Distribution Footprint Pete’s footprint is synergistic with Local Bounti’s expansion plan DETAIL VIEW Georgia Site Canada Carpinteria 400 Miles Warner Oxnard Robins, GA LB Farm Distribution Centers • Walmart LB Farm, Construction • Publix Pete’s Farm • Kroger • Albertson’s Pete’s Farm, Construction • Sprouts Distribution 4

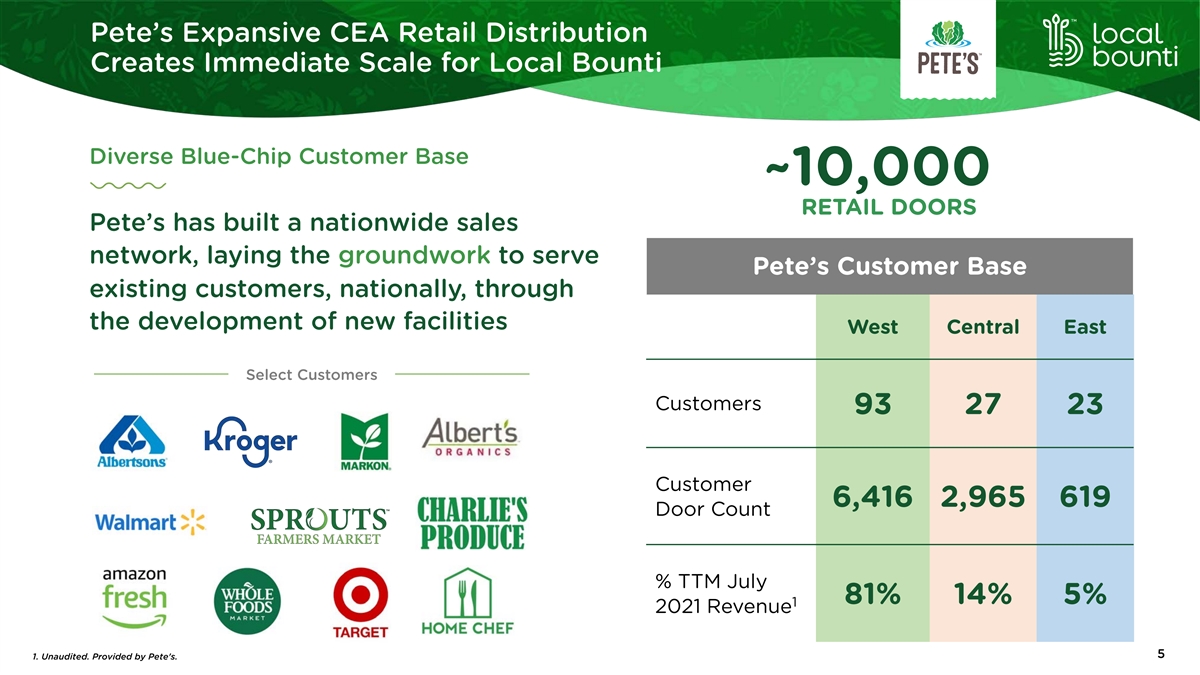

Pete’s Expansive CEA Retail Distribution Creates Immediate Scale for Local Bounti Diverse Blue-Chip Customer Base ~10,000 RETAIL DOORS Pete’s has built a nationwide sales network, laying the groundwork to serve Pete’s Customer Base existing customers, nationally, through the development of new facilities West Central East Select Customers Customers 93 27 23 Customer 6,416 2,965 619 Door Count % TTM July 81% 14% 5% 1 2021 Revenue 5 1. Unaudited. Provided by Pete's.

Diverse Blue-Chip Customer Base Pete's Delivers Deep & Diverse Blue-Chip Customer Base to Pete’s enjoys durable relationships Expand Local Bounti Presence with regional and national customers, as demonstrated by ~75% of net revenue generated in 2021 from 47% customers with a 5+ year tenure • Coast-to-coast coverage allows Pete’s to work with large retail, wholesale and foodservice accounts Durable Customer Relationships 24% • During 2021 Pete’s generated 81% of net revenue from retail and wholesale customers • Pete’s has a proven track record of 29% successful product introductions with its customers 6

Pete’s Established Category Penetration 1 Case Study CEA Indoor butter lettuce 1 CEA Production Increase replaces field-grown Since 2019 Market share of Market share of A growing share of crops are butter lettuce in CEA butter lettuce Western Region in Western Region 186.4% ($ in millions) ($ in millions) cultivated using hydroponic $32 $40 methods, highlighting CEA’s 19% 21% disruptive potential 82.9% • A rising share of products are CEA- 57.3% 81% 79% grown, highlighting customer and consumer adoption • Over 25% of tomatoes are grown 6.6% through CEA methods versus 9% % increase in CEA production since 2009 1 in 2003 Traditional Other CEA Peppers Cucumbers Lettuce Tomatoes Traditional CEAPete's All CEA CEA Pete’s • Certain products are now majority CEA-grown: ~ 81% of butter lettuce Over the past 12 years, production Pete’s shows how CEA product sold in the Western region of other vegetable varietals has can be more popular than shifted increasingly towards CEA traditional products (comprising the Pacific and 1 Mountain regions) is CEA-grown 7 1. USDA, Nielsen, Pete’s Estimates. Case study is not indicative of any future performance by Local Bounti or Pete's.

Pete’s Proven Operational Execution Track Record of Successful Expansion Industry-Leading Operations Pete’s has a long history of completing transformative Three distinct growing Proprietary fertilization State-of-the-art capital projects that boost systems, depending techniques for organic harvesting and packing on product category segments technology output and margins 1 Process Improvements Yield Gross Margin Expansion Development of Oxnard, CA Facility Pete’s acquired the Oxnard location in 2010, transforming a Gross margin for core lettuce Pete’s success in adding palm-tree farm into a highly efficient greenhouse product expanded ~600 basis pts both capacity and additional acreage in Expanded growing capabilities to include ponds, 1 California positions the gutters and channels Company for continued Increased yields and reduced growing cycles in expansion in Georgia as organic products through the implementation of 2 well as throughout other best practices, learned over 25+ years targeted geographic Launched new suite of organic and Greenhouse regions 2017A 2018A 2019A 3 Fresh products Lettuce Gross Margin (%) 8 1. Provided by Pete’s

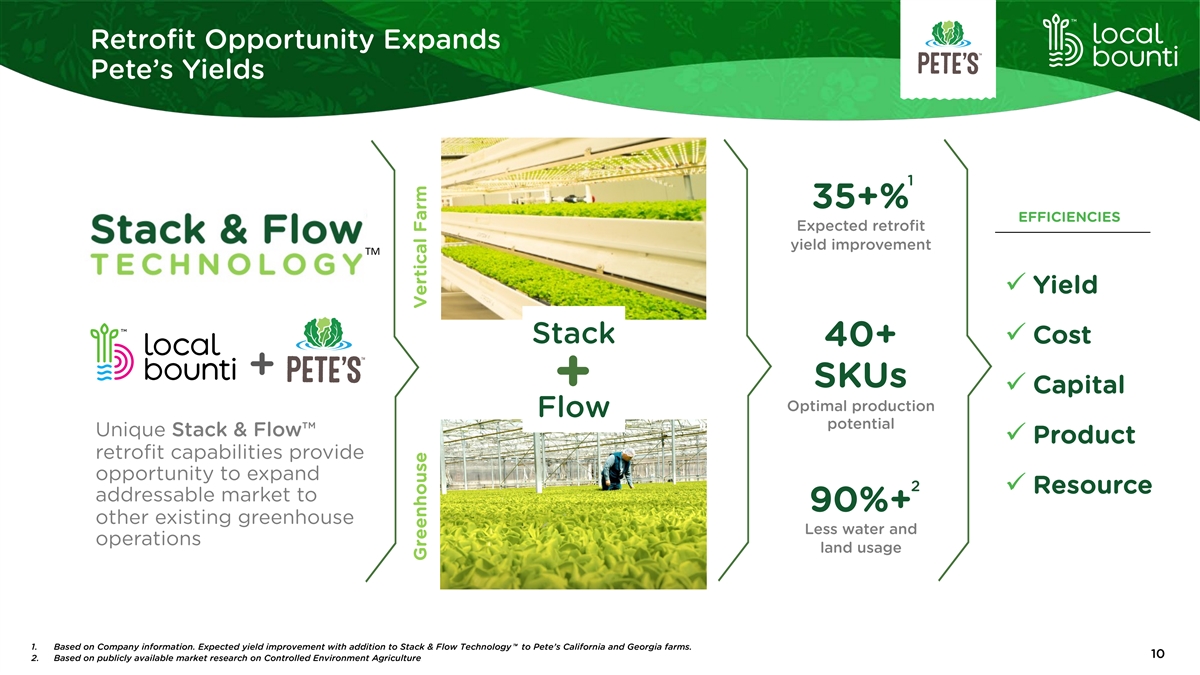

Substantial Operational Synergies Yield Efficiency Expanded Supply Chain Improvements Retail Presence Cost Savings • Incorporate Stack & Flow • Pete’s has an extensive • Pete’s has spent 25 years Technology™ at Pete’s retail network (~10,000 building an efficient three facilities doors vs. Local Bounti at supply chain (2 in California and 500 doors today) • Expect to utilize 1 in Georgia) • Immediately leverage significant cost savings Pete’s customer base to sell on inputs, such as raw • Leads to increased grow Local Bounti product in material procurement zone capacity and higher Northwestern US and beyond and packaging yields • Enable a multi-tiered brand strategy 9

Retrofit Opportunity Expands Pete’s Yields 1 35+% EFFICIENCIES Expected retrofit yield improvement TM ü Yield Stack ü Cost 40+ + SKUs + ü Capital Optimal production Flow potential Unique Stack & Flow™ ü Product retrofit capabilities provide opportunity to expand 2 ü Resource addressable market to 90%+ other existing greenhouse Less water and operations land usage 1. Based on Company information. Expected yield improvement with addition to Stack & Flow Technology™ to Pete’s California and Georgia farms. 10 2. Based on publicly available market research on Controlled Environment Agriculture. Greenhouse Vertical Farm

+ TURN A NEW LEAF Starting a new chapter in agriculture, together 11