Our Mission and Vision

Our mission is to bring our farm to your kitchen. Our vision is to deliver the freshest, locally grown produce over the fewest food miles. We believe that happy plants make happy taste buds and we are committed to reimagining the standards of freshness. We also believe that local is the best kind of business, and we are committed to helping communities thrive for generations to come. We are committed to building empowered local teams. Together, we believe we are capable of extraordinary things.

Company Overview

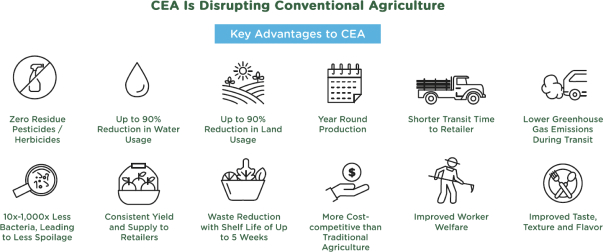

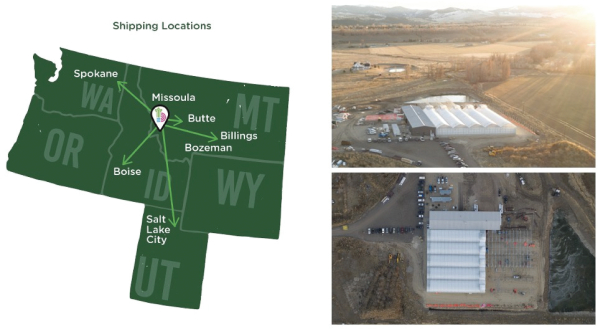

Local Bounti was founded in August 2018 and is headquartered in Hamilton, Montana. Local Bounti is a producer of sustainably grown living lettuce, herbs and loose leaf lettuce. We are a CEA company that utilizes patent pending Stack & Flow Technology

TM

, which is a hybrid of vertical farming and hydroponic greenhouse farming, to grow healthy food sustainably and affordably. Through our CEA process, it is our goal to produce our products in an environmentally sustainable manner that will increase harvest efficiency, limit water usage and reduce the carbon footprint of the production and distribution process. The environmental greenhouse conditions help to ensure nutritional value and taste, and that the products are non-genetically

modified organisms (“GMO”) and pesticide and herbicide free. Our products use 90% less water and 90% less land than conventional agriculture to produce. Our first CEA facility in Hamilton, Montana commenced construction in 2019 and reached full commercial operation by the second half of 2020. Local Bounti’s founders are Travis Joyner and Craig M. Hurlbert, business partners with a track record of building and managing capital-intensive, commodity-based businesses in industrial technology. After initially setting out to invest in a CEA business, Travis and Craig could not find a suitable existing business or technology in which to invest. Instead, they took a clean sheet approach and began to build a business with long-term CEA leadership in mind and a focus on unit economics and sustainability. With this background, we created our high yield and

low-cost

Stack & Flow Technology™

. We are differentiated by our focus on unit economics, modular and locally distributed strategy, brand and product diversity and strong focus on sustainability.

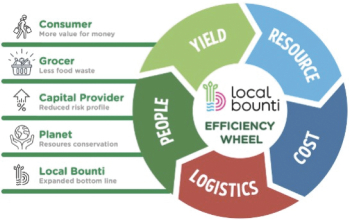

Our focus on unit economics defines our execution strategy, which underpins our value proposition and enhances value for all stakeholders as depicted in the diagram below.

|

|

Our hybrid facility design is at the core of our focus on unit economics, and serves as a platform intended to grow margins through investment in plant genetics and technology. In our facility configuration, we grow plants during their early development period “stacked” in a space and energy efficient vertical nursery. This configuration reduces facility square footage and increases returns on invested capital. This vertical nursery

246