Exhibit 99.2

local bounti Investor Presentation June 2021

Exhibit 99.2

local bounti Investor Presentation June 2021

Disclaimer local bounti This presentation (together with oral statements made in connection herewith, this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Local Bounti Corporation (“Local Bounti” or the “Company”) and Leo Holdings III Corp (“Leo III”) and related transactions (the “Proposed Business Combination”) and for no other purpose. By accepting this Presentation, you acknowledge and agree that all of the information contained herein or disclosed orally during this Presentation is confidential, that you will not distribute, disclose and use such information for any purpose other than for the purpose of your firm’s participation in the potential financing, that you will not distribute, disclose or use such information in any way detrimental to Local Bounti or Leo III, and that you will return to Local Bounti and Leo III, delete or destroy this Presentation upon request. No representations or warranties, express or implied are given in, or in respect of, the accuracy or completeness of this Presentation or any other information (whether written or oral) that has been or will be provided to you by any party, including but not limited to the placement agents. You are also being advised that the United States securities laws restrict persons with material non-public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. To the fullest extent permitted by law, in no circumstances will Leo III, Local Bounti, the placement agents or any of their respective subsidiaries, shareholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all inclusive or to contain all of the information that may be required to make a full analysis of Local Bounti or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Local Bounti and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. If the Proposed Business Combination is pursued, Leo III will be required to file a proxy statement and other relevant documents with the Securities and Exchange Commission (“SEC”). Shareholders and other interested persons are urged to read the proxy statement and any other relevant documents filed with the SEC when they become available because they will contain important information about Leo III, Local Bounti and the Proposed Business Combination. Shareholders will be able to obtain a free copy of the proxy statement (when filed), as well as other filings containing information about Leo III, Local Bounti and the Proposed Business Combination, without charge, at the SEC’s website located at www.sec.gov. Leo III, Local Bounti and their directors and executive officers and other persons may be deemed to be participants in the solicitations of proxies from Leo III’s shareholders in respect of the Proposed Business Combination and the other matters set forth in the definitive proxy statement. Information regarding Leo III’s directors and executive officers is available under the heading “Management” in Leo III’s final prospectus filed with the SEC on March 2, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement relating to the Proposed Business Combination when it becomes available. NO OFFER OR SOLICITATION This Presentation relates to the potential financing of a portion of the Proposed Business Combination through a private placement of Leo III’s Class A common stock. This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501(a)(1) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. Neither Local Bounti nor Leo III is making an offer of the Securities in any state where the offer is not permitted NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE FORWARD-LOOKING STATEMENTS All statements other than statements of historical facts contained in this Presentation are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Local Bounti’s and Leo III’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions and such differences may be material. Many actual events and circumstances are beyond the control of Local Bounti and Leo III. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the shareholders of Leo III or Local Bounti is not obtained; failure to realize the anticipated benefits of the Proposed Business Combination; risks relating to the uncertainty of the projected financial information with respect to Local Bounti; risks related to the rollout of Local Bounti’s business and the timing of expected business milestones; the effects of competition on Local Bounti’s business; the amount of redemption requests made by Leo III’s public shareholders; the ability of Leo III or the combined company to issue equity or equity-linked securities in connection with the Proposed Business Combination or in the future; and those factors discussed in Leo Ill’s final prospectus filed with the SEC on March 2, 2021 under the heading “Risk Factors” and other documents of Leo III filed, or to be filed, with the SEC. If any of these risks materialize or Leo III’s or Local Bounti’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Leo III nor Local Bounti presently know or that Leo III and Local Bounti currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Leo III’s and Local Bounti’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Leo III and Local Bounti anticipate that subsequent events and developments will cause Leo III’s and Local Bounti’s assessments to change. However, while Leo III and Local Bounti may elect to update these forward-looking statements at some point in the future, Leo III and Local Bounti specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Leo III’s and Local Bounti’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Disclaimer local bounti INDUSTRY AND MARKET DATA Although all information and opinions expressed in this Presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Local Bounti, Leo III and the placement agents have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Local Bounti and Leo III, which are derived from their respective reviews of internal sources as well as the independent sources described above. This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Local Bounti and Leo III. USE OF PROJECTIONS This Presentation contains projected financial information with respect to Local Bounti. Such projected financial information constitutes forward-looking information, is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. See “Forward-Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such information will be achieved. Neither Leo Ill’s nor Local Bounti’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement to be filed by Leo III with the SEC. Some of the financial information and data contained in this Presentation, such as Free Cash Flow before Spend, EBITDA and EBITDA Margin, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Leo III and Local Bounti believe that these non-GAAP financial measures provide useful information to management and investors regarding certain financial and business trends relating to Local Bounti’s financial condition and results of operations. Leo III and Local Bounti believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Local Bounti’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Local Bounti’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. TRADEMARKS AND TRADE NAMES Local Bounti and Leo III own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Local Bounti or Leo III, or an endorsement or sponsorship by or of Local Bounti or Leo III. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the *, TM or SM symbols, and the lack of references are not intended to indicate, in any way, that Local Bounti or Leo III will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. PARTICIPANTS IN THE SOLICITATION Leo III and its directors and executive officers may be deemed participants in the solicitation of proxies from Leo Ill’s shareholders with respect to the Proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in Leo III is contained in Leo Ill’s final prospectus related to its initial public offering dated February 25, 2021, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Leo Holdings III Corp at Albany Financial Center, South Ocean Blvd., Suite #507, P.O. Box SP- 63158, New Providence, Nassau, The Bahamas. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the Proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Leo III in connection with the Proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Proposed Business Combination will be included in the proxy statement for the Proposed Business Combination when available. 3

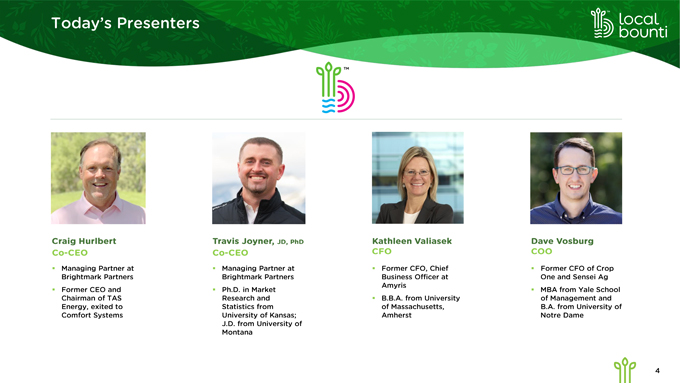

Today’s Presenters local bounty Craig Hurlbert Co-CEO Managing Partner at Brightmark Partners Former CEO and Chairman of TAS Energy, exited to Comfort Systems Travis Joyner, JD, PhD Co-CEO Managing Partner at Brightmark Partners Ph.D. in Market Research and Statistics from University of Kansas; J.D. from University of Montana Kathleen Valiasek CFO Former CFO, Chief Business Officer at Amyris B.B.A. from University of Massachusetts, Amherst Dave Vosburg COO Former CFO of Crop One and Sensei Ag MBA from Yale School of Management and B.A. from University of Notre Dame 4

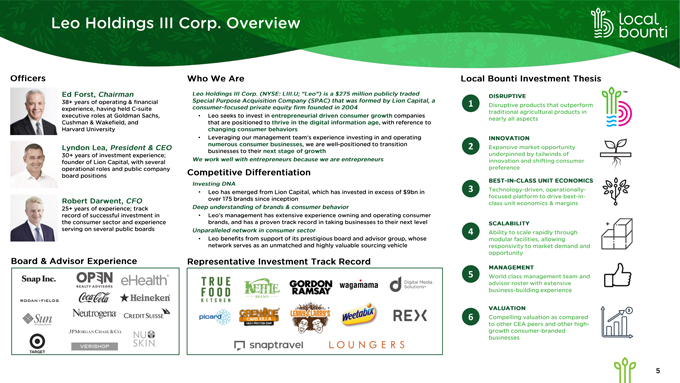

Leo Holdings III Corp. Overview local bounti Officers Ed Forst, Chairman 38+ years of operating & financial experience, having held C-suite executive roles at Goldman Sachs, Cushman & Wakefield, and Harvard University Lyndon Lea, President & CEO 30+ years of investment experience; founder of Lion Capital, with several operational roles and public company board positions Robert Darwent, CFO 25+ years of experience; track record of successful investment in the consumer sector and experience serving on several public boards Board & Advisor Experience Snap Inc. OPIN eHealth’ RODAN + FIELDS Heineken Neutrogena CreditSuisse JPMorgan Chase &Co. NU SKIN, TARGT VERISHOP Who We Are Leo Holdings III Corp. (NYSE: LIII.U; “Leo”) is a $275 million publicly traded Special Purpose Acquisition Company (SPAC) that was formed by Lion Capital, a consumer-focused private equity firm founded in 2004 Leo seeks to invest in entrepreneurial driven consumer growth companies that are positioned to thrive in the digital information age, with reference to changing consumer behaviors Leveraging our management team’s experience investing in and operating numerous consumer businesses, we are well-positioned to transition businesses to their next stage of growth We work well with entrepreneurs because we are entrepreneurs Competitive Differentiation Investing DNA Leo has emerged from Lion Capital, which has invested in excess of $9bn in over 175 brands since inception Deep understanding of brands & consumer behavior Leo’s management has extensive experience owning and operating consumer brands, and has a proven track record in taking businesses to their next level Unparalleled network in consumer sector Leo benefits from support of its prestigious board and advisor group, whose network serves as an unmatched and highly valuable sourcing vehicle Representative Investment Track Record TRUE FOOD KITCHEN INETTLE GORDON RAMSAY WAGAMAMA Digital Media Solutions Local Bounti Investment Thesis 1 DISRUPTIVE Disruptive products that outperform traditional agricultural products in nearly all aspects 2 INNOVATION Expansive market opportunity underpinned by tailwinds of innovation and shifting consumer preference 3 BEST-IN-CLASS UNIT ECONOMICS Technology-driven, operationally-focused platform to drive best-in-class unit economics & margins 4 SCALABILITY Ability to scale rapidly through modular facilities, allowing responsivity to market demand and opportunity 5 MANAGEMENT World class management team and advisor roster with extensive business-building experience 6 VALUATION Compelling valuation as compared to other CEA peers and other high- growth consumer-branded businesses 5

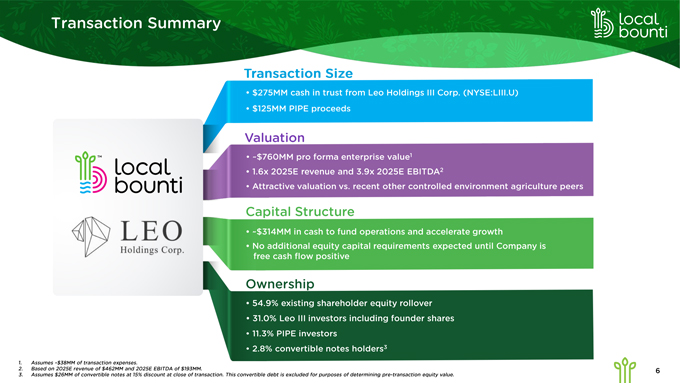

Transaction Summary TM local bounti TM local bounti LEO Holdings Corp. Transaction Size $275MM cash in trust from Leo Holdings III Corp. (NYSE:LIII.U) $125MM PIPE proceeds Valuation ~$760MM pro forma enterprise value11.6x 2025E revenue and 3.9x 2025E EBITDA2 Attractive valuation vs. recent other controlled environment agriculture peers Capital Structure~$314MM in cash to fund operations and accelerate growth No additional equity capital requirements expected until Company is free cash flow positive Ownership 54.9% existing shareholder equity rollover 31.0% Leo III investors including founder shares 11.3% PIPE investors 2.8% convertible notes holders3 1. Assumes ~$38MM of transaction expenses. 2. Based on 2025E revenue of $462MM and 2025E EBITDA of $193MM. 3. Assumes $26MM of convertible notes at 15% discount at close of transaction. This convertible debt is excluded for purposes of determining pre-transaction equity value. 6

local bounti Section 1 Industry Overview

Traditional Agriculture Is in Need of a Transformation Local bounti Imminent Agriculture Crisis The world will need ~70% more food to feed the global population in 2050, yet there will not be enough arable land and water to sustain traditional agriculture to meet these needs 1-in-4 200k 60% People globally are food insecure Deaths caused by E. coil globally each year Total global cropland severely depleted from irrigation use 9 mil 30% 10-30% Deaths each year from hunger Arable land lost in the U.S. in last 40 years Of product spoils at grocery before sale Sources: Canaccord Genuity, FAO, USDA, UN, Brauman et al. (2014), WHO, Mercy Corps, Food Safety News. 8

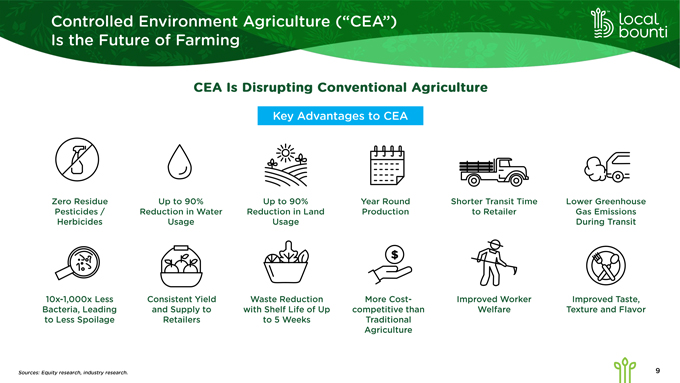

Controlled Environment Agriculture (“CEA”) Is the Future of Farming TM local bounti CEA Is Disrupting Conventional Agriculture Key Advantages to CEA Zero Residue Pesticides / Herbicides Up to 90% Reduction in Water Usage Up to 90% Reduction in Land Usage Year Round Production Shorter Transit Time to Retailer Lower Greenhouse Gas Emissions During Transit 10x-1,000x Less Bacteria, Leading to Less Spoilage Consistent Yield and Supply to Retailers Waste Reduction with Shelf Life of Up to 5 Weeks More Cost-competitive than Traditional Agriculture Improved Worker Welfare Improved Taste, Texture and Flavor Sources: Equity research, industry research. 9

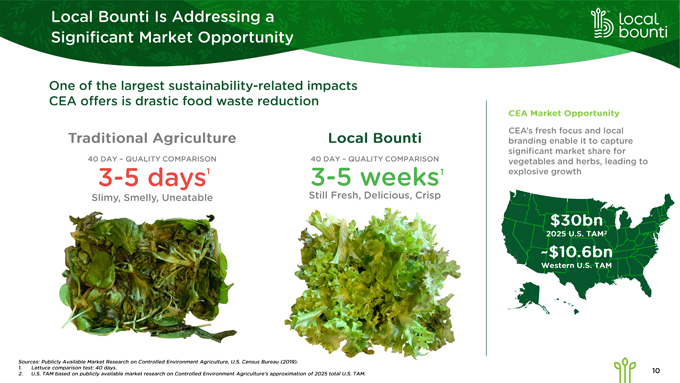

Local Bounti Is Addressing a Significant Market OpportunityTM local bounti One of the largest sustainability-related impacts CEA offers is drastic food waste reduction Traditional Agriculture Local Bounti CEA Market Opportunity 40 DAY - QUALITY COMPARISON 3-5 days1 Slimy, Smelly, Uneatable 40 DAY - QUALITY COMPARISON 3-5 weeks1 Still Fresh, Delicious, Crisp CEA’s fresh focus and local branding enable it to capture significant market share for vegetables and herbs, leading to explosive growth $30bn 2025 U.S. TAM2 ~$10.6bn Western U.S. TAM Sources: Publicly Available Market Research on Controlled Environment Agriculture, U.S. Census Bureau (2019). 1. Lettuce comparison test: 40 days. 2. U.S. TAM based on publicly available market research on Controlled Environment Agriculture’s approximation of 2025 total U.S. TAM. 10

Why We Started Local Bounti local bounti TM local bounti Travis and Craig wanted to invest in CEA, but could not find the ideal existing business after performing due diligence They became very excited to start with a “clean sheet” and to build a business with long-term CEA leadership in mind Existing CEA participants were not focused enough on unit economics; Travis and Craig back solved for Local Bounti’s patent pending, high yield and low cost technology A very large $30Bn estimated U.S. TAM by 2025 added to the appeal, due to the concept of “replacement product” Travis and Craig have a complementary skill set with a long history of experience building and managing capital intensive, commodity-based businesses 11

local bounti Section 2 Company Overview

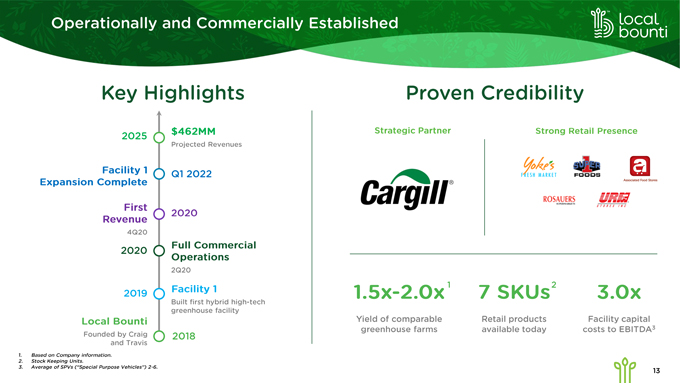

Operationally and Commercially Established TM local bounti Key Highlights Proven Credibility 2025 Facility 1 Expansion Complete First Revenue 4Q20 2020 2019 Local Bounti Founded by Craig and Travis $462MM Projected Revenues QI 2022 2020 Full Commercial Operations 2Q20 Facility 1 Built first hybrid high-tech greenhouse facility 2018 Strategic Partner Strong Retail Presence Cargill 1.5X-2.0X1 Yield of comparable greenhouse farms 7 SKUS2 Retail products available today 3.0X Facility capital costs to EBITDA3 1. Based on Company information. 2. Stock Keeping Units. 3. Average of SPVs (“Special Purpose Vehicles”) 2-6. 13

Local Bounti’s Differentiated Approach local bounti Unit Economics Local, Distributed & Logistics Strategy Brand and Product Diversity Sustainable Achieves superior production unit economics through facility design, technology and plant science R&D Turn-key ready to scale modular approach, enables flexibility to respond rapidly to market demand Security of year round supply of locally grown pesticide- and herbicide-free produce delivered at peak freshness Proximity of farms enables significant reduction in transportation logistics and associated costs Strong retailer and customer loyalty through branded strategy and superior product Enables an efficient business model for grocers by providing multiple SKUs, resulting in fewer supply requirements and reduction in waste Mission-driven for sustainability and human welfare Strong ESG alignment, directly addressing more than half of Sustainable Development Goals 14

Local Bounti Has Strong ESG Alignment TM local bounti SUSTAINABLE DEVELOPMENT GOALS 1 NO POVERTY 2 ZERO HUNGER 3 GOOD HEALTH AND WELL-BEING 4 QUALITY EDUCATION 5 GENDER EQUALITY 6 CLEAN WATER AND SANITATION 7 AFFORDABLE AND CLEAN ENERGY 8 DECENT WORK AND ECONOMIC GROWTH 9 INDUSTRY, INNOVATION AND INFRASTRUCTURE 10 REDUCED INEQUALITES 11 SUSTAINABLE CITIES AND COMMUNITIES 12 RESPONSIBLE CONSUMPTION AND PRODUCTION 13 CLIMATE ACTION 14 LIFE BELOW WATER 15 LIFE ON LAND 16 PEACE, JUSTICE AND STRONG INSTITUTIONS 17 PARTNERSHIPS FOR THE GOALS Local Bounti exhibits exceptional ESG performance, directly addressing over half of the U.N. Sustainable Development Goals SDG 2: Enables access to fresh food SDG 6: 90% less water usage as compared to conventional agriculture SDG 7: Energy-efficient facilities SDG 8: Provides full-time, quality jobs SDG 9: Invests in sustainable infrastructure and technology SDG 11: Increases jobs, taxes and investment in cities SDG 12: Significantly reduces food waste SDG 13: Fewer emissions than traditional agriculture SDG 14: Eliminates agricultural runoff SDG 15: Utilizes 90% less land than field-grown agriculture Sources: U.N. Sustainable Development. 15

Local Bounti Video TM local bounti local bounti 16

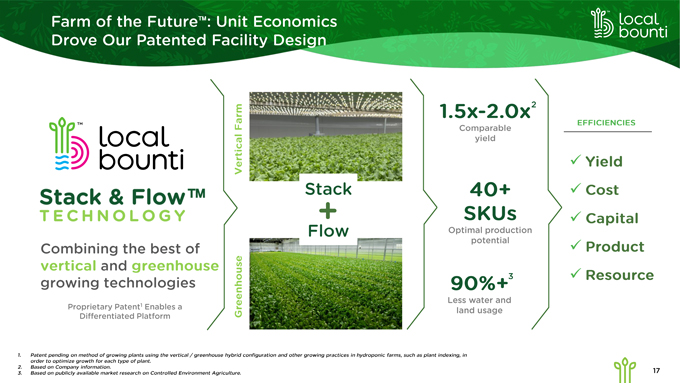

Farm of the FutureTM: Unit Economics Drove Our Patented Facility Design TM local bounti TM local bounti Stack & Flow TM TECHNOLOGY Combining the best of vertical and greenhouse growing technologies Proprietary Patent1 Enables a Differentiated Platform Vertical farm Stack + Flow Greenhouse 1.5x-2.0x2 Comparable yield 40+SKUs Optimal production potential 90%+3 Less water and land usage EFFICIENCIES Yield Cost Capital Product Resource 1. Patent pending on method of growing plants using the vertical / greenhouse hybrid configuration and other growing practices in hydroponic farms, such as plant indexing, in order to optimize growth for each type of plant 2. Based on Company information. 3. Based on publicly available market research on Controlled Environment Agriculture. 17

Retail: Current Go-to-Market Diversified Product Offerings TM local bounti LB $ Turns Lbs UOS Unit Economics Cut Lettuce Green Leaf, Red Leaf, Butter, Romaine Living Lettuce Butter Lettuce Living Herbs Basil, Cilantro Days to Harvest TM local bounti 16 days1 28 days2 16-21 days Greenhouse 24 days 50+ days 38 days Vertical / Warehouse 24-30 days X 35-45 days 1. Days to harvest for Romaine Lettuce SKU. 2. Days to harvest for Butter Lettuce SKU. 18

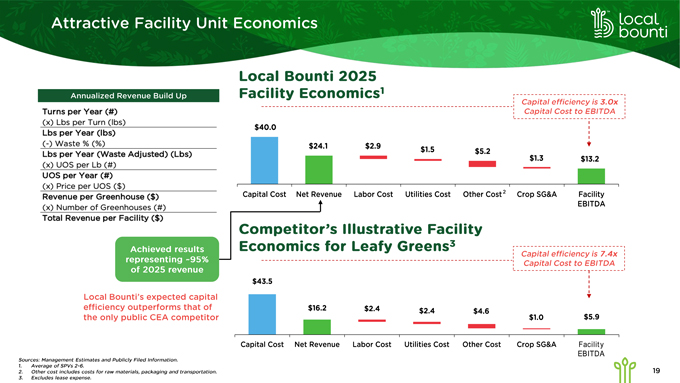

Attractive Facility Unit Economics TM local bounti Annualized Revenue Build Up Turns per Year (#) (x) Lbs per Turn (lbs) Lbs per Year (lbs) (-) Waste % (%) Lbs per Year (Waste Adjusted) (Lbs) (x) UOS per Lb (#) UOS per Year (#) (x) Price per UOS ($) Revenue per Greenhouse ($) (x) Number of Greenhouses (#) Total Revenue per Facility ($) Achieved results representing ~95% of 2025 revenue Local Bounti’s expected capital efficiency outperforms that of the only public CEA competitor Local Bounti 2025 Facility Economics1 Capital efficiency is 3.0x Capital Cost to EBITDA $40.0 $24.1 $2.9 $1.5 $5.2 $1.3 $13.2 Capital Cost Net Revenue Labor Cost Utilities Cost Other Cost2 Crop SG&A Facility EBITDA Competitor’s Illustrative Facility Economics for Leafy Greens3 Capital efficiency is 7.4x Capital Cost to EBITDA $43.5 $16.2 $2.4 $2.4 $4.6 $1.0 $5.9 Capital Cost Net Revenue Labor Cost Utilities Cost Other Cost Crop SG&A Facility EBITDA Sources: Management Estimates and Publicly Filed Information. 1. Average of SPVs 2-6. 2. Other cost includes costs for raw materials, packaging and transportation. 3. Excludes lease expense. 19

Deep-Rooted Quality from Right Next Door TM local bounti Produt offering Living Herbs Basil Cilantro Living Lettuce Butter Cut Lettuce Green Leaf Red Leaf Butter Romaine OUR BRAND PROMISE Sustainably Grown Pesticide Free Non-GMO Greenhouse protected Longer Lasting Freshness Locally Grown in the Northwest WA MT OR ID WY 20

Delivering Results! TM local bounti Local Bounti is a first mover and already in distribution, currently providing delicious, fresh produce at over 100 local retail locations “We all know fresh is best, Local Bounti is the real deal” Steven Pheil, Produce Manager Super 1 Super 1 FOODS “Local Bounti provides a great addition to our local produce offerings. Their consistent production of high quality produce at scale on a year-around basis here in the Northern Rockies is not only impressive but very much appreciated by our customers who always want more local options.” Dave Pranther, GM Western Montana Growers Co-op WESTERN MONTANA GROWERS COOPERATIVE “Local Bounti and its products hit the mark on a number of levels: From being locally produced, high quality freshness, environmentally friendly, value for dollar and most importantly the product performs when the consumer gets it home. We look forward to seeing what Local Bounti plans to produce next!” Michael Kamphaus, President and CEO Peirone Produce Company PEJRONE PRODUCE CO. – EST. 1945 - 21

Highly Experienced Management Team TM local bounti Management team with proven track record backed by deep industry knowledge and diverse set of core competencies will differentiate the Local Bounti platform Craig Hurlbert Co-CEO Travis Joyner JD, PhD Co-CEO Dave Vosburg COO Kathleen Valiasek CFO Josh White CMO CIO VP, Operations & Finance VP, Business Development VP, Real Estate VP, Science & Technology VP, Sustainability VP, Financial Planning & Analysis VP, Engineering & Design VP, People & Safety VP, Production VP, Commercial Previous Experience Chobani CropOne* curaleaf ge JACK LINKS 100% GRASSFED MAPLE HILL Organic robinson FRESH BUSHEL BOY SENSEI Ag nightfood Zappos.com plenty Square Roots Albertsons Johnson Controls SUPERVALU Mc McCormick UGC UTAH GAS CORP amyris Pacific PLUG & LINER SUNSET Earthbound Farm. ORGANIC KULI KULI Sources: Company information. 22

TM local bounti Section 3 Investment Highlights

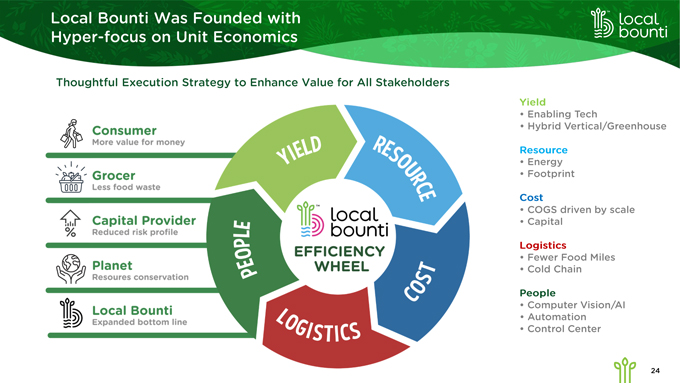

Local Bounti Was Founded with Hyper-focus on Unit Economics TM local bounti Thoughtful Execution Strategy to Enhance Value for All Stakeholders Consumer More value for money Grocer Less food waste Capital Provider Reduced risk profile Planet Resoures conservation Local Bounti Expanded bottom line YIELD RESOURCE COST LOGISTICS PEOPLE TM local bounti EFFICIENCY WHEEL Yield Enabling Tech Hybrid Vertical/Greenhouse Resource Energy Footprint Cost COGS driven by scale Capital Logistics Fewer Food Miles Cold Chain People Computer Vision/AI Automation Control Center 24

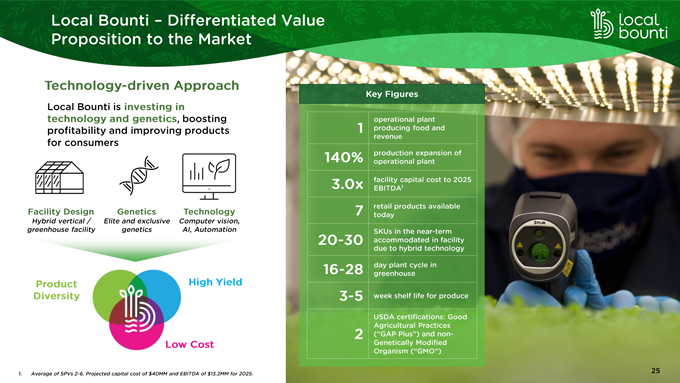

Local Bounti - Differentiated Value Proposition to the Market TM local bounti Technology-driven Approach Local Bounti is investing in technology and genetics, boosting profitability and improving products for consumers Facility Design Hybrid vertical / greenhouse facility Genetics Elite and exclusive genetics Technology Computer vision, Al, Automation Product Diversity High Yield Low Cost Key Figures 1operational plant producing food and revenue 140% production expansion of operational plant 3.0x facility capital cost to 2025 EBITDA1 7 retail products available today 20-30 SKUs in the near-term accommodated in facility due to hybrid technology 16-28 day plant cycle in greenhouse 3-5 week shelf life for produce 2 USDA certifications: Good Agricultural Practices (“GAP Plus”) and non-Genetically Modified Organism (“GMO”) 1. Average of SPVs 2-6. Projected capital cost of $40MM and EBITDA of $13.2MM for 2025. 25

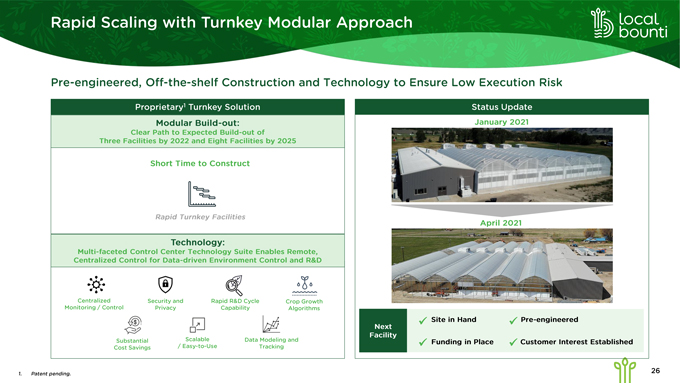

Rapid Scaling with Turnkey Modular Approach TM local bounti Pre-engineered, Off-the-shelf Construction and Technology to Ensure Low Execution Risk Proprietary1 Turnkey Solution Modular Build-out: Clear Path to Expected Build-out of Three Facilities by 2022 and Eight Facilities by 2025 Short Time to Construct Rapid Turnkey Facilities Technology: Multi-faceted Control Center Technology Suite Enables Remote, Centralized Control for Data-driven Environment Control and R&D Centralized Monitoring / Control Security and Privacy Rapid R&D Cycle Capability Crop Growth Algorithms Substantial Cost Savings Scalable / Easy-to-Use Data Modeling and Tracking Status Update January 2021 April 2021 Next Facility Site in Hand Pre-engineered Funding in Place Customer Interest Established 1. Patent pending. 26

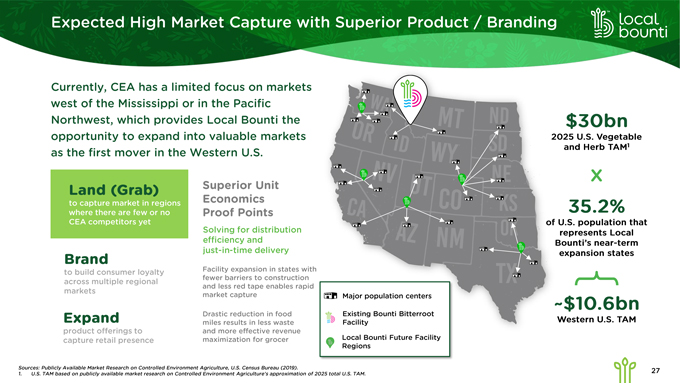

Expected High Market Capture with Superior Product / Branding TM local bounti Currently, CEA has a limited focus on markets west of the Mississippi or in the Pacific Northwest, which provides Local Bounti the opportunity to expand into valuable markets as the first mover in the Western U.S. Land (Grab) to capture market in regions where there are few or no CEA competitors yet Brand to build consumer loyalty across multiple regional markets Expand product offerings to capture retail presence Superior Unit Economics Proof Points Solving for distribution efficiency and just-in-time delivery Facility expansion in states with fewer barriers to construction and less red tape enables rapid market capture Drastic reduction in food miles results in less waste and more effective revenue maximization for grocer Major population centers Existing Bounti Bitterroot Facility Local Bounti Future Facility Regions $30bn 2025 U.S. Vegetable and Herb TAM1 X 35.2% of U.S. population that represents Local Bounti’s near-term expansion states ~$10.6bn Western U.S. TAM Sources: Publicly Available Market Research on Controlled Environment Agriculture, U.S. Census Bureau (2019). 1. U.S. TAM based on publicly available market research on Controlled Environment Agriculture’s approximation of 2025 total U.S. TAM. 27

Expected High Market Capture with Broad Product Offering TM local bounti Local Bounti’s branded strategy is enabled by high product diversity that captures more in-store real estate Land (Grab) to capture market in regions where there are few or no CEA competitors yet Brand to build consumer loyalty across multiple regional markets Expand product offerings to capture retail presence Expanding Existing Shelf 20-30 SKUs in the near-term 40+ SKU potential Creating New Product Categories CEA competitors only compete in 25% of the products that Local Bounti produces 3-5 week shelf life vs. 3-5 day shelf life for field-grown product leads to substantially less waste for grocers and consumers 28

Multiple Pathways for Potential Growth Expansion TM local bounti Clear pathways for growth in the medium term by leveraging Local Bounti’s capabilities around R&D, branded strategy and food production International Expansion Rapidly expanding CEA markets in the Middle East and Asia provide Local Bounti the opportunity to deliver CEA expertise without capital investment Subscription-based Service Consistency in yield and product year-round enable Local Bounti to provide future direct-to-consumer offerings New Product & Segment Investment in R&D strengthens Local Bounti’s new product innovation and segment expansion Franchising & Licensing License superior technology or genetics patents to other non-core indoor agriculture companies and leverage Local Bounti’s brand for franchising 29

Sustainably Grown TM local bounti Section 4 Summary Financials and Transaction Overview

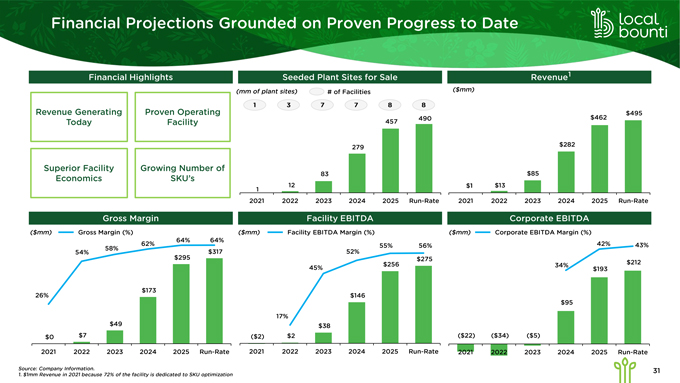

Financial Projections Grounded on Proven Progress to Date TM local bounti Financial Highlights Revenue Generating Today Proven Operating Facility Superior Facility Economics Growing Number of SKU’s Seeded Plant Sites for Sale (mm of plant sites) # of Facilities 1 3 7 7 8 8 1 12 83 279 457 490 2021 2022 2023 2024 2025 Run-Rate Revenue1 ($mm) $1 $13 $85 $282 $462 $495 2021 2022 2023 2024 2025 Run-Rate Gross Margin ($mm) Gross Margin (%) 26% 54% 58% 62% 64% 64% $0 $7 $49 $173 $295 $317 2021 2022 2023 2024 2025 Run-Rate Facility EBITDA ($mm) Facility EBITDA Margin (%) 17% 45% 52% 55% 56% ($2) $2 $38 $146 $256 $275 2021 2022 2023 2024 2025 Run-Rate Corporate EBITDA ($mm) Corporate EBITDA Margin (%) 34% 42% 43% ($22) ($34) ($5) $95 $193 $212 2021 2022 2023 2024 2025 Run-Rate Source: Company Information. 1. $1mm Revenue in 2021 because 72% of the facility is dedicated to SKU optimization 31

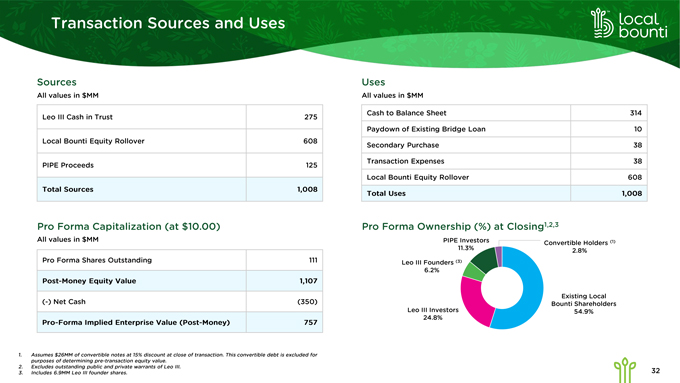

Transaction Sources and Uses local bounti Sources All values in $MM Leo III Cash in Trust 275 Local Bounti Equity Rollover 608 PIPE Proceeds 125 Total Sources 1,008 Pro Forma Capitalization (at $10.00) All values in $MM Pro Forma Shares Outstanding 111 Post-Money Equity Value 1,107 (-) Net Cash (350) Pro-Forma Implied Enterprise Value (Post-Money) 757 Uses All values in $MM Cash to Balance Sheet 314 Paydown of Existing Bridge Loan 10 Secondary Purchase 38 Transaction Expenses 38 Local Bounti Equity Rollover 608 Total Uses 1,008 Pro Forma Ownership (%) at Closing1,2,3 PIPE Investors 11.3% Leo III Founders (3) 6.2% Convertible Holders (1) 2.8% Leo III Investors 24.8% Existing Local Bounti Shareholders 54.9% 1. Assumes $26MM of convertible notes at 15% discount at close of transaction. This convertible debt is excluded for purposes of determining pre-transaction equity value. 2. Excludes outstanding public and private warrants of Leo III. 3. Includes 6.9MM Leo III founder shares. 32

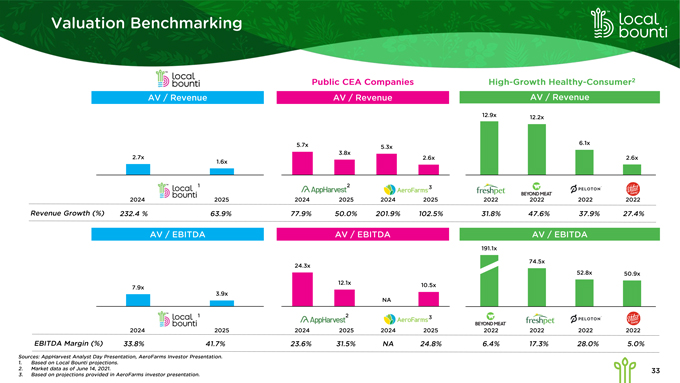

Valuation Benchmarking local bounti local bounti AV / Revenue 2.7x 1.6x Public CEA Companies AV / Revenue 5.7x 3.8x 5.3x 2.6x High-Growth Healthy-Consumer2 AV / Revenue 12.9x 12.2x 6.1x 2.6x local bounti1 2024 2025 Revenue Growth (%) 232.4% 63.9% AppHarvest2 2024 2025 77.9% 50.0% AeroFarms3 2024 2025 201.9% 102.5% freshpet 2022 31.8% BEYOND MEAT 2022 47.6% PELOTON 2022 37.9% Vital Farms® 2022 27.4% AV / EBITDA 7.9x 3.9x AV / EBITDA 24.3x 12.1x NA 10.5x AV / EBITDA 191.1x 74.5x 52.8x 50.9x local bounti1 2024 2025 EBITDA Margin (%) 33.8% 41.7% AppHarvest2 2024 2025 23.6% 31.5% AeroFarms3 2024 2025 NA 24.8% BEYOND MEAT 2022 6.4% freshpet 2022 17.3% PELOTON 2022 28.0% Vital Farms® 2022 5.0% Sources: AppHarvest Analyst Day Presentation, AeroFarms Investor Presentation. 1. Based on Local Bounti projections. 2. Market data as of June 14, 2021. 3. Based on projections provided in AeroFarms investor presentation. 33

Local Bounti Is a Premier Controlled Environment Agriculture Company TM local bounti Premier Controlled Environment Agriculture (“CEA”) company that redefines conversion efficiency and ESG standards for indoor agriculture Leading with technology, Local Bounti pushes the limits on bottom-line expansion and is well positioned to grow rapidly Stack & Flow TechnologyTM Model is Crafted for Disruption Exceptional Unit Economics Local, Sustainable and Superior Brand Proven Patent Pending Technology Turn-Key and Ready to Scale Geographic First Mover Highly Experienced Management Team Strong Strategic Partnerships 34

Q&A 35

TM local bounti Supplementary Materials

Proven Leadership Team TM local bounti Craig Hurlbert Co-CEO Craig Hurlbert is a seasoned entrepreneur - with a thirty-year track record of building successful businesses with strong leadership teams. Craig was named Ernst & Young Entrepreneur of the Year in 2009 in the Houston and Gulf Coast Area and inducted into the Ernst & Young Entrepreneur of the Year Hall of Fame that same year. Craig most recently served as Managing Partner and Co-Founder at BrightMark Partners, a growth equity and management firm dedicated to providing capital and resources to venture, growth phase and middle market businesses. Craig served as the President, CEO and Chairman of the Board of Houston based TAS Energy from December 2001 to April of 2020. TAS is the leading provider of high efficiency and modular cooling and energy systems for the data center, commercial, industrial and power generation markets. TAS was sold to publicly traded Comfort Systems (FIX) on April 1st of 2020. Mr. Hurlbert is also the Chairman of the Board at Clearas Water Recovery, a company utilizing patented, sustainable and proprietary technology to solve high nutrient wastewater challenges in the municipal and industrial water markets. Craig also held leadership roles at GE and North American Energy Services. He earned a BS in Finance from San Diego State University and an MBA from California State University - Long Beach. Travis Joyner Co-CEO Travis has extensive experience in growth businesses, with a proven track record of helping companies springboard to the next level. Prior to co-founding Local Bounti, he was the Co-Founder and Managing Partner at BrightMark Partners, a growth equity and management consulting firm dedicated to providing capital and resources to venture, growth phase and middle market businesses. In this position, he was an active director for many portfolio companies, driving growth plan execution, building core business infrastructure and leading many successful debt and equity transactions. Previously, Travis had a career in management consulting and market research, consulting to a broad range of companies, from Fortune 500 to start-ups. His areas of expertise include quantitative analysis, corporate strategy, technology development, organizational design and structure, market strategy, branding and capital campaigns. Travis earned a Ph.D. from the University of Kansas, where his graduate focus was market research and statistics. He also studied at the Wharton School at the University of Pennsylvania, earning a Certificate of Finance, and received his J.D. from the University of Montana, earning a Certificate in Mediation and serving as the Managing Editor of the Montana Law Review. He earned his B.A. from the University of North Carolina-Chapel Hill, graduating with Distinction. Kathleen Valiasek CFO An entrepreneurial executive, Kathleen brings a 30 year record of driving profitable growth in public and privately held companies from start-ups to Fortune 500 companies, within the biotech, retail, telecommunications, real estate and healthcare markets. Most recently, Kathleen served as CFO and CBO of Amyris, Inc., a publicly traded biotech and commercial stage manufacturing company with global operations. She closely partnered with the CEO to expand product offerings in B2B and consumer markets. Kathleen raised over $1bn in debt and equity financing while simultaneously reducing debt and attracting institutional investors. As CBO, Kathleen led the strategic market entry into the pharmaceutical industry. During her tenure, Amyris’ market cap grew from $300MM to $5bn. Prior to Amyris, Kathleen provided strategic and financial consulting services through Lenox Group, Inc., the company she founded in 1996. Clients included Fortune 500 companies such as Albertsons, CVS, Gap, Kaiser Permanente and Softbank, as well as smaller clients preparing for IPOs. She was typically engaged for critical roles on multi-year assignments including M&A transactions, debt and equity financings, IPOs and spin-offs. Kathleen earned a Bachelor of Business Administration - Accounting from the University of Massachusetts, Amherst. Dave Vosburg COO Dave Vosburg has spent his life founding, growing and scaling technology businesses that creates significant social value. He joins Local Bounti with nearly two decades of international financial, business development and technology experience. Prior to Local Bounti, Dave served as the CFO of Sensei Ag, a market changing AgTech venture founded by Oracle co-founder Larry Ellison and physician and scientist Dr. David Agus. Dave was previously Head of Business Development and Chief Financial Officer of Crop One Holdings, Inc., a vertical farming company. As CFO, Dave created a $50MM joint venture with Emirates Flight Catering to construct one of the world’s largest vertical farms. He also secured $134MM in the first Take-and-Pay contracts in the vertical farming industry and co-founded Conception Nurseries, a technology licensee to expand Crop One into new verticals such as agricultural genetics. In his early career, Dave founded and grew Ed-Tech and Fin-Tech companies spent a number of years in Zambia working in C-suite roles within the Ed-Tech and financial technology sectors. Dave earned a BA in Political Science from the University of Notre Dame and an MBA from the Yale School of Management. 37

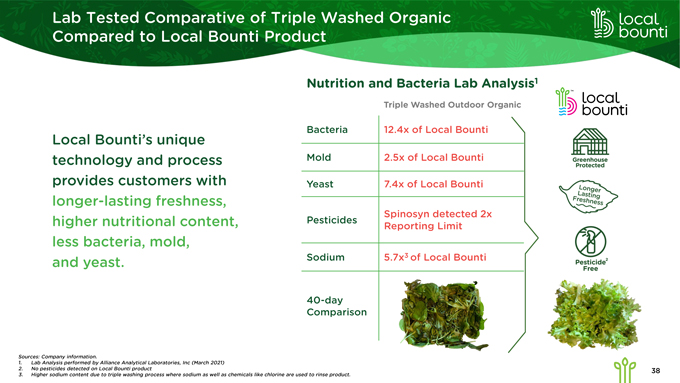

Lab Tested Comparative of Triple Washed Organic Compared to Local Bounti Product TM local bounti Local Bounti’s unique technology and process provides customers with longer-lasting freshness, higher nutritional content, less bacteria, mold, and yeast. Nutrition and Bacteria Lab Analysis1Triple Washed Outdoor Organic Bacteria 12.4x of Local Bounti Mold 2.5x of Local Bounti Yeast 7.4x of Local Bounti Pesticides Spinosyn detected 2x Reporting Limit Sodium 5.7x3 of Local Bounti 40-day Comparison local bounti Greenhouse Protected Longer Lasting Freshness Pesticide2 Free Sources: Company information. 1. Lab Analysis performed by Alliance Analytical Laboratories, Inc (March 2021) 2. No pesticides detected on Local Bounti product 3. Higher sodium content due to triple washing process where sodium as well as chemicals like chlorine are used to rinse product. 38

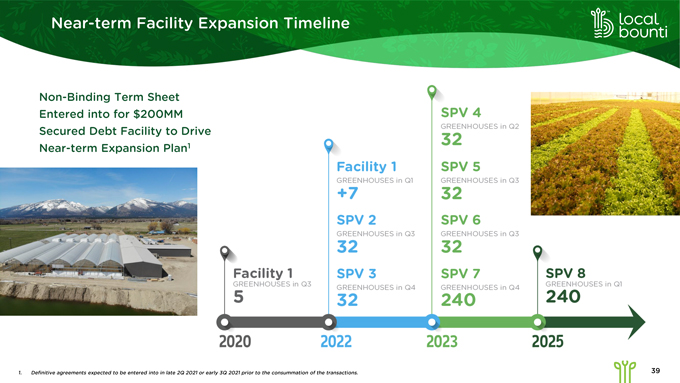

Near-term Facility Expansion Timeline TM local bounti Non-Binding Term Sheet Entered into for $200 MM Secured Debt Facility to Drive Near-term Expansion Plan1 Facility 1 GREENHOUSES in Q3 5 2020 Facility 1 GREENHOUSES in Q1 +7 SPV 2 GREENHOUSES in Q3 32 SPV 3 GREENHOUSES in Q4 32 2022 SPV 4 GREENHOUSES in Q2 32 SPV 5 GREENHOUSES in Q3 32 SPV 6 GREENHOUSES in Q3 32 SPV 7 GREENHOUSES in Q4 240 2023 SPV 8 GREENHOUSES in Q1 240 2025 1. Definitive agreements expected to be entered into in late 2Q 2021 or early 3Q 2021 prior to the consummation of the transactions. 39

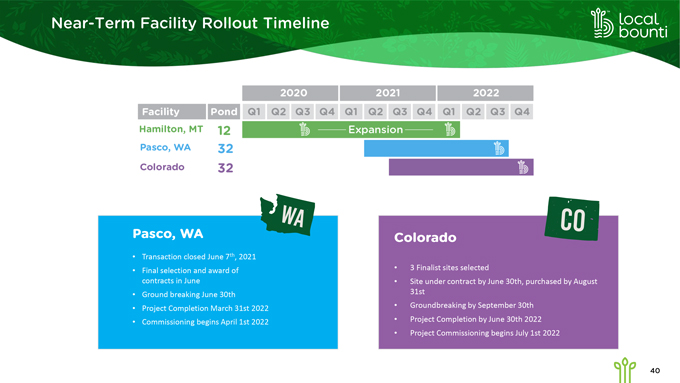

Near-Term Facility Rollout Timeline TM local bounti Facility Pond Hamilton, MT 12 Pasco, WA 32 Colorado 32 2020 Q1 Q2 Q3 Q4 2021 Q1 Q2 Q3 Q4 2022 Q1 Q2 Q3 Q4 Expansion WA Pasco, WA Transaction closed June 7th, 2021 Final selection and award of contracts in June Ground breaking June 30th Project Completion March 31st 2022 Commissioning begins April 1st 2022 CO Colorado 3 Finalist sites selected Site under contract by June 30th, purchased by August 31st Groundbreaking by September 30th Project Completion by June 30th 2022 Project Commissioning begins July 1st 2022 40

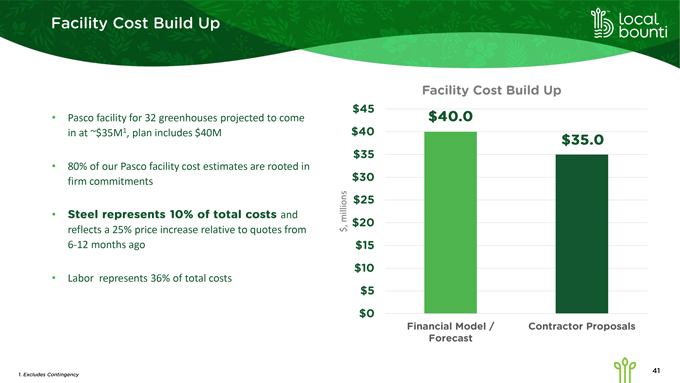

Facility Cost Build Up TM local bounti Pasco facility for 32 greenhouses projected to come in at ~$35M1, plan includes $40M 80% of our Pasco facility cost estimates are rooted in firm commitments Steel represents 10% of total costs and reflects a 25% price increase relative to quotes from 6-12 months ago Labor represents 36% of total costs Facility Cost Build Up $, millions $45 $40 $35 $30 $25 $20 $15 $10 $5 $0 $40.0 $35.0 Financial Model / Forecast Contractor Proposals 1. Excludes Contingency 41

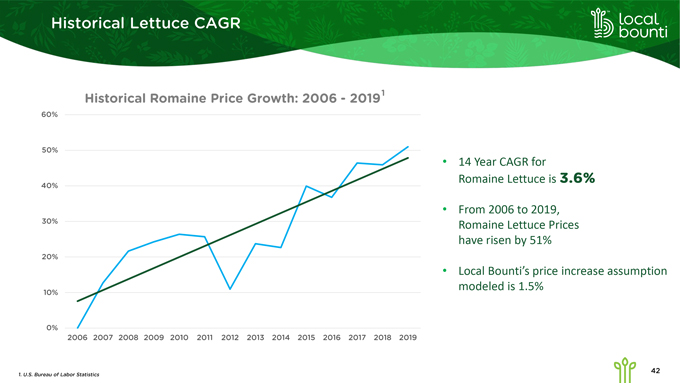

Historical Lettuce CAGR TM local bounti Historical Romaine Price Growth: 2006 - 20191 60% 50% 40% 30% 20% 10% 0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 14 Year CAGR for Romaine Lettuce is 3.6% From 2006 to 2019, Romaine Lettuce Prices have risen by 51% Local Bounti’s price increase assumption modeled is 1.5% 1. U.S. Bureau of Labor Statistics 42